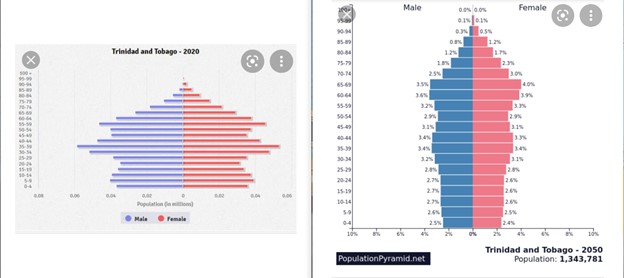

The recent furor caused by the proposal to change the retirement age in our country from 60 to 65 is understandable, as it may appear draconian and unfair, particularly for those on the cusp of retirement. When we look at some of the underlying factors however, the move is in fact long overdue and not as unreasonable as it may seem.

As it is understandable that persons who have made their plans and have been looking forward to retiring at 60 will undoubtedly be disappointed by an increased retirement age, it would perhaps be wise to implement this change in T&T on a staggered basis, similar to what is done in the US and Britain. This has also been the recommendation from the most recent Actuarial Report of the NIB fund ie to phase in the increase in the current age of eligibility for the National Insurance pension to age 65, over a 10 year period starting in 2025. This is important, as it provides affected citizens with time to reflect and adjust their retirement goals if needed. Furthermore, persons would still be able to take early retirement and access the NIB pension at age 60, though it would be at a reduced pension and not the full amount as if they waited to retire at the new proposed age of 65.

Given the projected continuing increase in life expectancy rates, it would then follow naturally that contribution amounts and/or working years will have to be subsequently increased for our children and grandchildren in order to sustain OUR retirement payouts. This supports the progressive move, 50 years after it was first set, to start increasing the country’s retirement age in keeping with current and forecasted trends of persons living longer, while the purchasing power of a dollar saved today contracts over time.

Registered Address / 27 Agra Street, St. James, Port of Spain

T /+1(868) 267 3737

E / admin@exeqtrust.com

Disclaimer / This website and publications herein do not provide legal advice.

You have successfully registered for our Newsletter