1. After your death, Wills make the process of divvying up your estate clearer and less traumatic for your loved ones, minimising disagreements and ensuring that your resources go to the people or organisations you intended.

2. You are leaving:

(a) Legacies for any of the following:

(b) Assets which include:

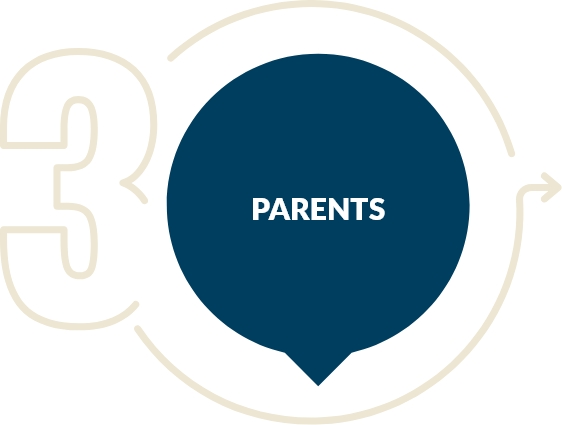

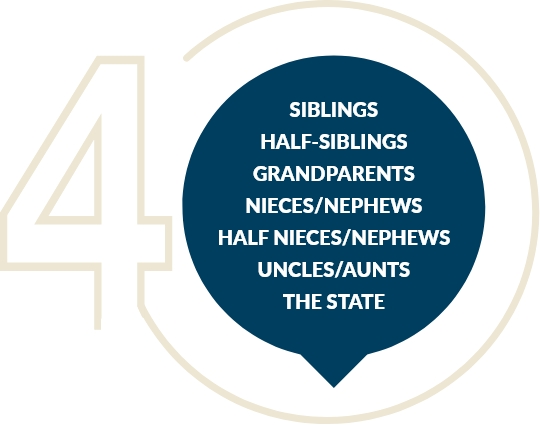

3. If you die without leaving a Will, your assets will be automatically distributed to your next of kin, as per the local laws of intestacy.

100% if no child(ren)

If no spouse, 100% to child or divided equally amongst children, including grandchildren of pre-deceased children only.

IF BOTH: 50% to spouse/ cohabitant, 50% to be shared equally amongst child(ren)

If there is no spouse or child(ren)

If NO Spouse, Child(ren) or Parents, then 100% to the first category of relatives above, which the deceased still has alive

This means that no one from any of the following categories will be able to inherit your assets upon your death:

4. In the absence of a will, the Probate Registry will appoint an administrator for your estate from among your legal next of kin—usually in the same order as the diagram above—so there’s a strong chance the person who ends up taking charge of your estate may be the last person you would have chosen.

Making a Will gives you that peace of mind.

5. Wills allow you to nominate the guardians of your minor children in the event of your (and your spouse’s simultaneous) death. Though not legally binding, the Family Court takes these intentions expressed in your Will into serious consideration.

6. Wills also have the power to help you plan financially for your loved ones, even after you’re gone, by stipulating when and at what ages they can receive certain funds and inheritances.

A divorced business owner died without a Will. The elder of his two adult children became administrator of the estate, but information gathering to collate their father’s assets took a long time. The legal process, too, was involved and time consuming, prompting the family to switch law firms in the hope of getting quicker, more personalised service. Even without family squabbles, the final grant of administration was only obtained 15 years later.

Registered Address / 35 Bombay Street, St. James, Port of Spain

T /+1(868) 267 3737

E / admin@exeqtrust.com

Disclaimer / This website and publications herein do not provide legal advice.

You have successfully registered for our Newsletter